You can then multiply the variety of work hours by their hourly price and use the sum you find yourself with as their gross pay. The IRS revised this doc in 2020, but employees employed earlier than the revision usually are not required to fill out the model new version of the W-4 form. This doc stays with the employer and shouldn’t be submitted to the IRS. Apart from personal information, employees are asked to provide information regarding their marital standing, select the popular filing technique and claim dependents. It’s additionally important to keep in mind that all businesses are required to report a new worker within 20 days to the Employer New Hire Reporting Operations Middle at the Texas Workplace of Legal Professional Basic.

First, review their timesheets to ensure they’ve precisely tracked their hours. Then merely multiply their hours for that week, or month, by their hourly rate. Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions. You can discover a rundown of state-by-state charges and maximums on the best.

If you’re simply beginning your business and planning to do your personal accounting and payroll, you might want to think about buying some high quality accounting software program. It is not going to only prevent a substantial quantity of https://www.quickbooks-payroll.org/ time, however guarantee error-free payroll and tax calculations. If you do your own payroll and tax calculations by hand, you’ll want to hold ledgers of every little thing you withhold and pay. But understand that most accounting software program instruments, like QuickBooks or Freshbooks, incorporate payroll accounting capabilities and will do all this be excellent for you.

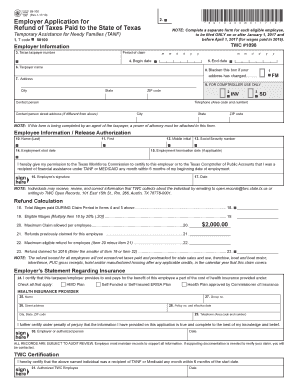

The Texas Unemployment Compensation Act (TUCA) establishes reporting requirements for employers relating to worker wages. Employers should report gross wages every quarter based on amounts paid rather than accrued, for the first $9, 000 per worker annually. Reporting have to be accomplished electronically via the Texas Workforce Fee (TWC) unless a waiver is obtained, otherwise penalties could apply. Key subjects for model new employers embody employee classification, employer liability, tax charges, taxable wage limits, and submitting necessities. All liable employers in Texas must submit State Unemployment Insurance (SUI) taxes quarterly, with payments due by the final day of the month after each quarter, besides on weekends or legal holidays. Employers should withhold federal revenue taxes from employee paychecks, adjusted primarily based on particular person wages and withholding allowances.

Finished Using The Payroll Calculator Texas Employers Trust? Write Your Employees’ Paychecks!

Drill all the way down to see the details of each payroll tax to study the method it will affect your corporation. Again, be sure to check together with your native authorities to seek out out about paying any native payroll taxes. Jane, for example, might pay $130 in federal taxes, $15 in social safety, and $40 in state taxes, along with $30 in 401(k). Payroll deductions, which are specified by the employee on their tax returns, are quantities that can be deducted from taxable revenue.

The Texas Structure particularly prohibits personal income taxes, which is a major aspect of its tax construction. As A Substitute, Texas relies on alternative revenue sources, primarily high sales and property taxes, to compensate for the absence of an income tax. Navigating the Texas tax structure is crucial for ensuring compliance with federal filings and local levies, in addition to maintaining efficient report management. Additionally, the Texas Tax Code consists of compliance requirements, obligations, exemptions, audits, and potential penalties. Although Texas does not have a person income tax, it does charge a state gross receipts tax and sales tax on retail transactions, with local gross sales taxes potentially including as much as an extra 2 %. Texas has no state income tax, however employers must register with the Texas Workforce Commission to pay state unemployment taxes (SUTA).

- Employers must contribute 6% of the first $7,000 of their employees’ annual earnings toward the federal unemployment tax (FUTA).

- Furthermore, unemployment insurance coverage can’t be deducted from the employee’s pay, and a enterprise must cover the worth of this tax.

- The solely state tax a Texas-based enterprise has to cowl is the unemployment insurance tax that ranges from zero.37% to six.3% of the first $9.000 an worker earns in a year.

How Are Sui Taxes Calculated?

Enterprise house owners additionally want to consider court-ordered wage garnishments, child support funds, and worker contributions to accounts every time applicable. Employers in Texas must deduct the correct quantities from their employee’s paychecks and submit them to the appropriate authorities on time. Rates change yearly per path from the IRS and are worth often monitoring even as you get extra snug with reporting Texas payroll taxes. Right Here is a full listing of the federal and state payroll taxes you’ll need to think about when doing payroll in Texas.

Payroll taxes are the payments that employers make once they run payroll for his or her employees. Income tax is levied on individuals’ salaries, wages and other incomes. You can use Forbes Advisor’s Revenue Tax Calculator to estimate how a lot you’ll owe or whether or not you’ll qualify for a refund. Calculating payroll taxes can be sophisticated, but many payroll providers can deal with the calculations, payments and submitting for you routinely. Evaluate our record of one of the best payroll companies to discover a platform that fits your corporation. All states acquire unemployment tax to fund advantages for qualifying jobless people beneath the Federal Unemployment Tax Act (FUTA) and State Unemployment Tax Act (SUTA).

Texas Property Tax

So, if you have to use slightly more help managing the math, check out some of the calculators listed beneath. Texas is exclusive because it does not have a state earnings tax, resulting in paychecks being solely subject to federal taxes, which include federal income tax, Social Safety, and Medicare. Consequently, Texas residents need to contemplate only federal income tax when calculating their take-home pay. Payroll and payroll taxes include countless legal guidelines and restrictions, and a payroll service can ensure your business stays in compliance on the federal, state, and native ranges. You’ll just ship over your digital timesheets and related info and the service supplier will deal with the calculations, funds and taxes, releasing you up to focus on employer taxes in texas rising your corporation.

The TWC points the cost schedule for the unemployment insurance tax every year, and businesses must follow the most recent updates so as to know how frequently they have to pay this state tax. These elements are used to discover out the UI tax fee that varies from 0.31% to six.3% of the employee’s wage. However, the tax only applies to the primary $9,000 an worker makes in a fiscal yr.